Toronto’s Street Contxt Helps Asset Managers Navigate Through The Content Chaos

by Fintechnews Switzerland February 1, 2018Canadian startup Street Contxt has developed a platform that aims to address the current inefficiencies in the flow of information in the capital markets by bringing clarity to the current content chaos.

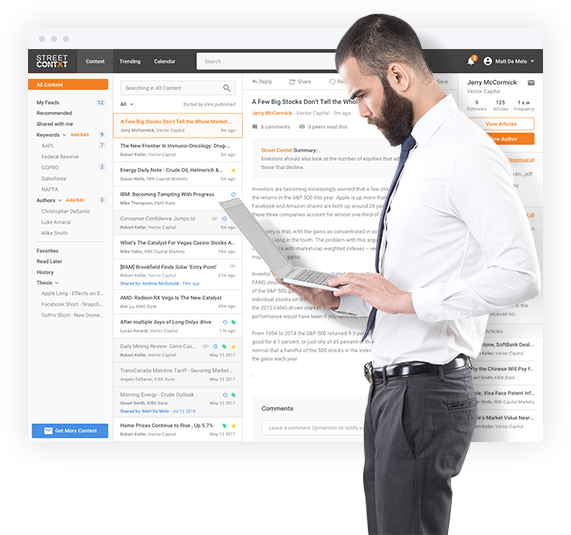

Founded in 2012, Street Contxt provides a content management platform that allows traders, sales people, desk analysts and research analysts, to easily organize, manage, distribute and track engagement in their desk commentary, research reports and news updates.

Using proprietary, smart data technology and machine learning, the platform allows sell side content producers to figure out what research is resonating with clients, and match the right people with the right content.

Content providers send their research to a firm’s virtual inbox where users within the organization can mark it up, make comments on it and share it with colleagues.

Content providers send their research to a firm’s virtual inbox where users within the organization can mark it up, make comments on it and share it with colleagues.

“This can be a formal research but also a desk notes, traders notes, morning-call notes, macroeconomic pieces as well as everything in between,” explained Blair Livingston, CEO and founder of Street Contxt.

Street Contxt built a content contextualization index system into the platform that suggests available content to which the user is entitled.

“Any piece of content that is delivered by Street Contxt gets scanned in real-time for keywords, names, ticker symbols, asset classes and named entities then scored,” Livingston said. “Instantly, the machine knows what the topic is, how important the article is to people and will recommend it to users based on analysis of what content to which they subscribe, receive and consume.”

This allows buy side participants such as hedge funds, pension funds and institutional asset managers, to easily subscribe to the right content and only get research offerings that are pertinent to them.

According to Livingston, portfolio managers and buy side analysts are oversubscribed to formal and informal research offerings and have trouble separating the wheat from the chaff. “Whether a portfolio manager or buy side analyst, they will not consumer content from half the people who provide it,” Livingston said.

This is mainly because of the buy side’s lack of content management capabilities or reliance on point solutions that are designed to manage individual inboxes.

“Our goal is to make sure the entire investment community has the right tools to manage content efficiently, effectively and intelligently,” Livingston said.

Street Contxt has attracted support and investment from a roster of retired Wall Streeters JP Morgan’s former head of business development and strategy Jay Mandelbaum and the former chief technology officer of UBS Andy Brown.

The startup has raised US$12 million in funding so far.

Featured image by Pixabay.