New UK Wealthtech Directory Features 447 Providers; 32 are Swiss

by Fintechnews Switzerland March 12, 2020The Wealth Mosaic, a knowledge resource for the wealth management sector, has released its first UK Wealth Technology Landscape Report, a directory-based guide to the UK wealth management sector’s technology and related solution providers.

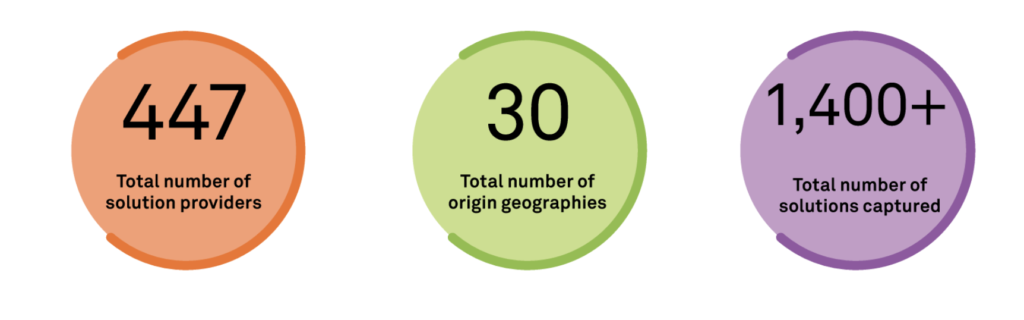

The directory features 447 solution providers coming from 30 different origin geographies, and which combine 1,400+ solutions. These companies are pure tech providers specialized in wealth management that either have wealth management clients in the UK, target wealth management clients in the UK, or have solution offerings that match the many business needs of UK wealth managers.

Among the 447 entries, 32 are Swiss wealthtech companies. For example Additiv, AAAccell, Avaloq, Appway, InvestGlass, SIX Financial, Sentifi, ti&m, and Temenos.

Among the 447 entries, 32 are Swiss wealthtech companies. For example Additiv, AAAccell, Avaloq, Appway, InvestGlass, SIX Financial, Sentifi, ti&m, and Temenos.

Two of these Swiss providers, namely Adviscent and Orbium, shared insight on the state of wealthtech, and the need for the traditional wealth management industry to adopt new technologies.

Thomas Bosshard

Thomas Bosshard, co-founder and CEO of Zurich-based Adviscent, which specializes in information management solutions for advisory processes, explained how technology can streamline the wealth management process and help advisors to build a stronger and deeper relationship with clients.

The main advantage of enhancing digital capabilities lie in improved efficiency and the ability to engage more broadly with clients, he said, with key areas where technology can have the greatest impact being client engagement, customization of investment advice, and optimization of back-office processes.

The UK Wealth Technology Landscape Report, launched in June 2019, was the first release from the Wealth Mosaic’s Landscape Report Series, which focuses on the wealthtech sector in specific geographies, business needs and types of wealth managers.

In March, it released the WealthTech Views: Looking into 2020 report, a paper that features 11 interview-based articles from a range of wealthtech and consulting solution providers from countries such as Switzerland, Germany, Italy, the Netherlands, the UK and the US. These experts share their opinions on the main tech opportunities and challenges for the wealth management industry in 2020.

Thomas Schäubli

For Thomas Schäubli, head of marketing at Apiax, a Swiss regtech startup, companies will need to leverage the right tools and technologies that will allow them to grow their business despite the increasing regulatory headwinds.

For Jamie Whatley, director of sales and account Management at Crealogix, a digital banking engagement platform provider, most wealth management firms have not yet embraced a digital-first or e-commerce-like approach, and most urgently place technology and digitally-driven growth as key themes in their overall business strategy.

Ian Woodhouse, head of strategy and change at Orbium, a Swiss management and technology consulting firm part of Accenture Wealth Management, believes that technology is undergoing a seismic shift with the rise of artificial intelligence (AI), machine learning (ML) and blockchain, among others. All these cutting-edge technologies will provide opportunities but AI and ML in particular will be key in supporting scale and efficiency in the “human-machine interface.”

In 2019, wealthtech remained high in deal count despite being not quite as active as other sub-segments such as payments and blockchain, according to KPMG’s Pulse of Fintech H2’19 study.

Indeed, shifting demographics, higher expectations and changes in consumer tastes are driving a focus on better user interfaces and seamless desktop-to-mobile experiences, pushing investors to back wealthtech-focused enterprises and acquire startups to gain relevant capabilities, the report says.

In 2019, wealthtech companies raised US$474.1 million through 29 deals, a significant decrease compared with 2018 (US$703.6 million through 36 deals) showcasing that investors focused less on early stage companies with interesting ideas and more on those companies in their portfolios looking for follow-on investments.

Data management and analysis were a key focus for investment in 2019, with companies looking for more effective ways to assess and report on real-time data, the report says.

Featured image credit: Unsplash