Though neobanks have continued to gain market share over the past years, consumers are still reluctant to work with these as their main accounts, according to an Accenture research.

The 2020 Accenture Global Banking Consumer Survey, which polled more than 47,000 consumers in 28 markets, found that despite an uptake in neobank adoption – 23% of surveyed consumers in 2020 having a neobank account, compared to 17% in 2019 –, the proportion of customers that actually use their neobank account as their primary account remains very low at 12%.

The research found that consumers’ enthusiasm for neobanks is now somewhat moderate, with neobank customers citing convenience, simplicity and price point as the elements they were the most pleased with, rather than neobanks’ novel features, personalized offerings or their brands in general.

Reasons for opening an account with a neobank, Source: 2020 Accenture Global Banking Consumer Survey

Of those who have a neobank account but who do not use it for the majority of their transactions, the vast majority said the primary reason for that was that they were happy with their existing banks.

With traditional banks continuing to make improvements and introduce digital offerings, Accenture believes that the competition will only get fiercer in the digital banking space.

Specifically, UK consumers were found to be particularly skeptical of neobanks, with only 10% placing “a lot” of trust in them to look after their data, compared to 41% for traditional banks, and just 45% believing that neobanks will survive the next 12 months.

A fifth of UK consumers responded “not at all” when asked if they trusted neobanks to look after their financial wellbeing.

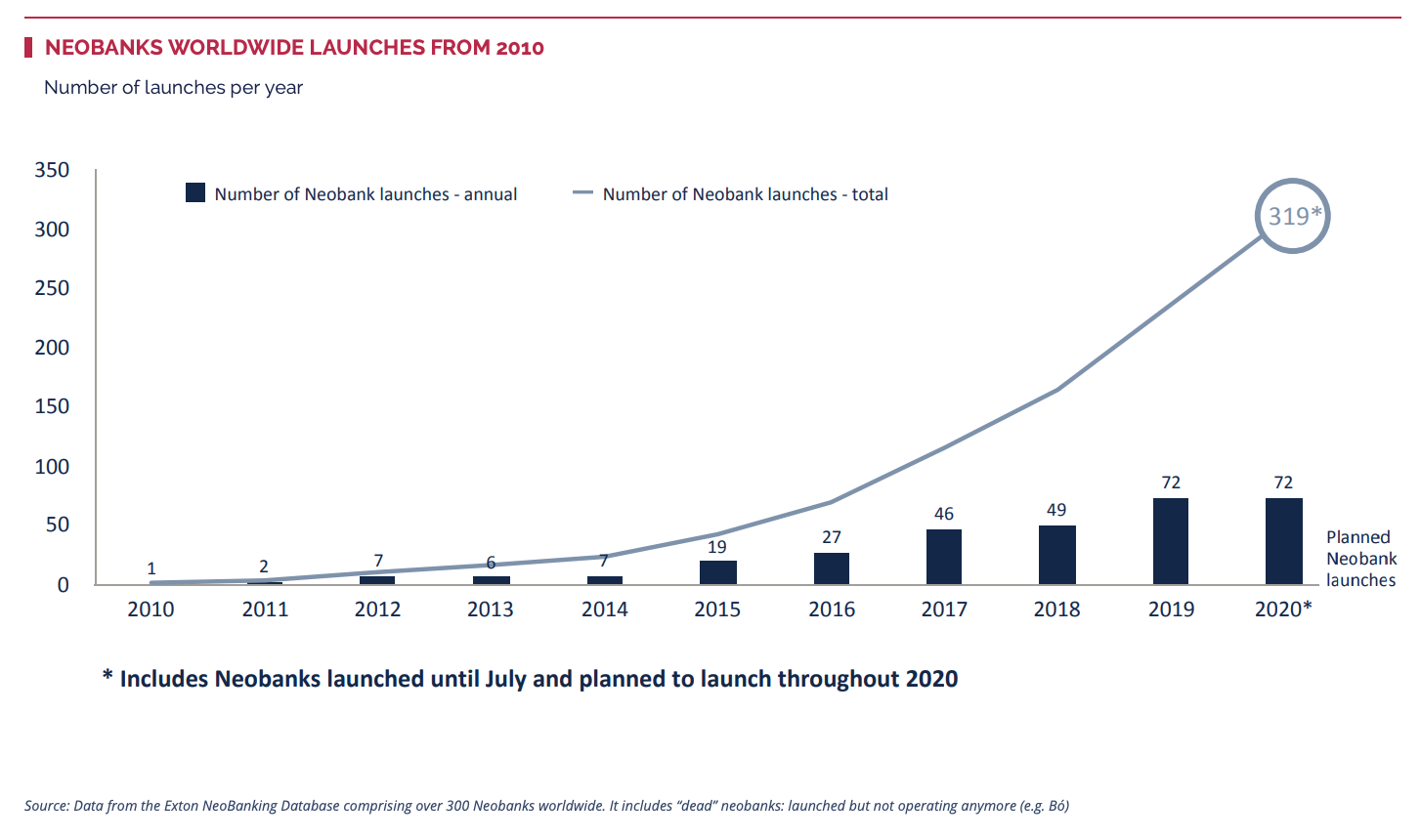

The number of neobanks worldwide has tripled since 2017, surging from about 100 to nearly 300 in November 2020, according to consultancy firm Exton Consulting. Dozens of new players are planning to go live in 2021, including Greece’s Woli and First Boulevard from the US.

Neobanks worldwide launches from 2010, Source: Data from the Exton NeoBanking Database, Exton Consulting, Nov 2020

Continental Europe currently leads the world with 74 live neobanks, while the UK has single-handedly produced no less than 37 neobanks already – the biggest individual innovation capacity in the sector.

Latin America counts 46 neobanks, North America, 44, Asia-Pacific 34, and Africa and the Middle East 21.

Live neobanks overview worldwide, Source: Data from the Exton NeoBanking Database, Exton Consulting, Nov 2020

Currently, 43 neobanks (about 17%) operate multi-geographically, with those from the European Union (EU) in particular leveraging passporting mechanisms to expand across the region.

Revolut and Transferwise, for example, are both headquartered in the UK but now operate in more than 30 markets with plans to expand further in the near future. Revolut currently has 13 million customers and a valuation of US$5.5 billion. The startup has recently applied for a UK banking license.

Transferwise, which started off as a low-cost international money transfer app back in 2011, has expanded its offering to now provide a multi-currency account, an accompanying debit card, and soon, investment products. Transferwise claims eight million customers worldwide, and says it has been profitable since 2017. A secondary share sale in July 2020 valued the company at US$5 billion.