IFZ Insurtech Study: European Insurtech Industry Increased 20% This Year

by Fintechnews Switzerland December 15, 2022Over the past year, Europe’s insurtech industry has seen the addition of more than 100 companies, bringing the total number of insurtech firms in the continent to 598, a new report by the Swiss Institute of Financial Services Zug IFZ shows. The figure represents a 20% increase from last year’s reported 497 insurtech companies and showcases the industry’s dynamism despite a trying funding environment.

The IFZ Insurtech Report 2022, released on December 02, 2022, gives an overview of the European insurtech industry, delving into emerging trends observed over the past year both in the continent and in Switzerland specifically.

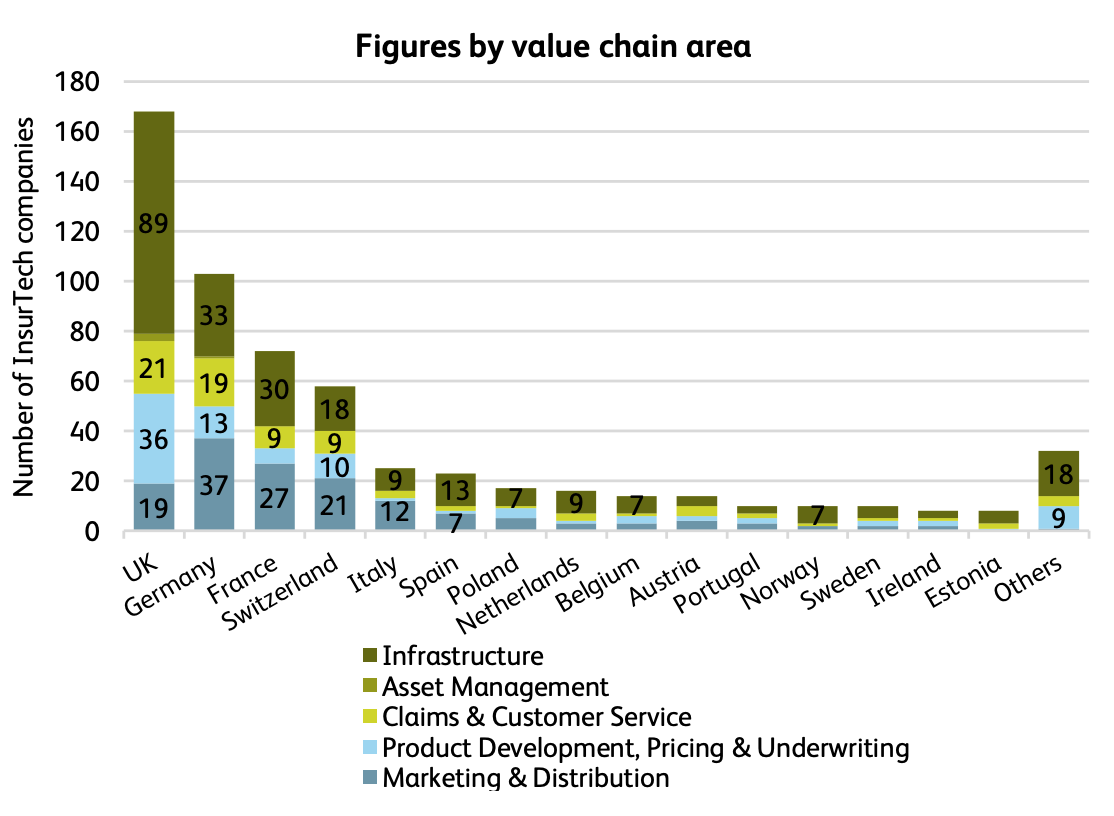

This year again, the UK, Germany and France maintained their leading positions in Europe’s insurtech scene, hosting the region’s largest insurtech ecosystems and a combined 57% of all companies in Europe (343 companies).

With 168 companies, the UK makes up for 28% of all European insurtech companies, followed by Germany with 103 (17%) and France with 72 (12%). Switzerland remained at the fourth position in 2022 with a reported 58 firms, up eight companies from last year’s 50.

Number of European insurtechs by country of headquarters and value chain (left graph), Source: IFZ Insurtech Report 2022

The growth of Europe’s insurtech industry comes despite a global startup funding contraction that’s taken a toll on several players and forced many to cut jobs. US-headquartered Next Insurance, an unicorn startup worth US$4 billion, laid off 150 employees in July, citing a “worsening macroeconomic environment.” That same month, Zego, a commercial motor insurance provider from the UK valued at US$1.1 billion, made 17% of its staff redundant after facing increased costs.

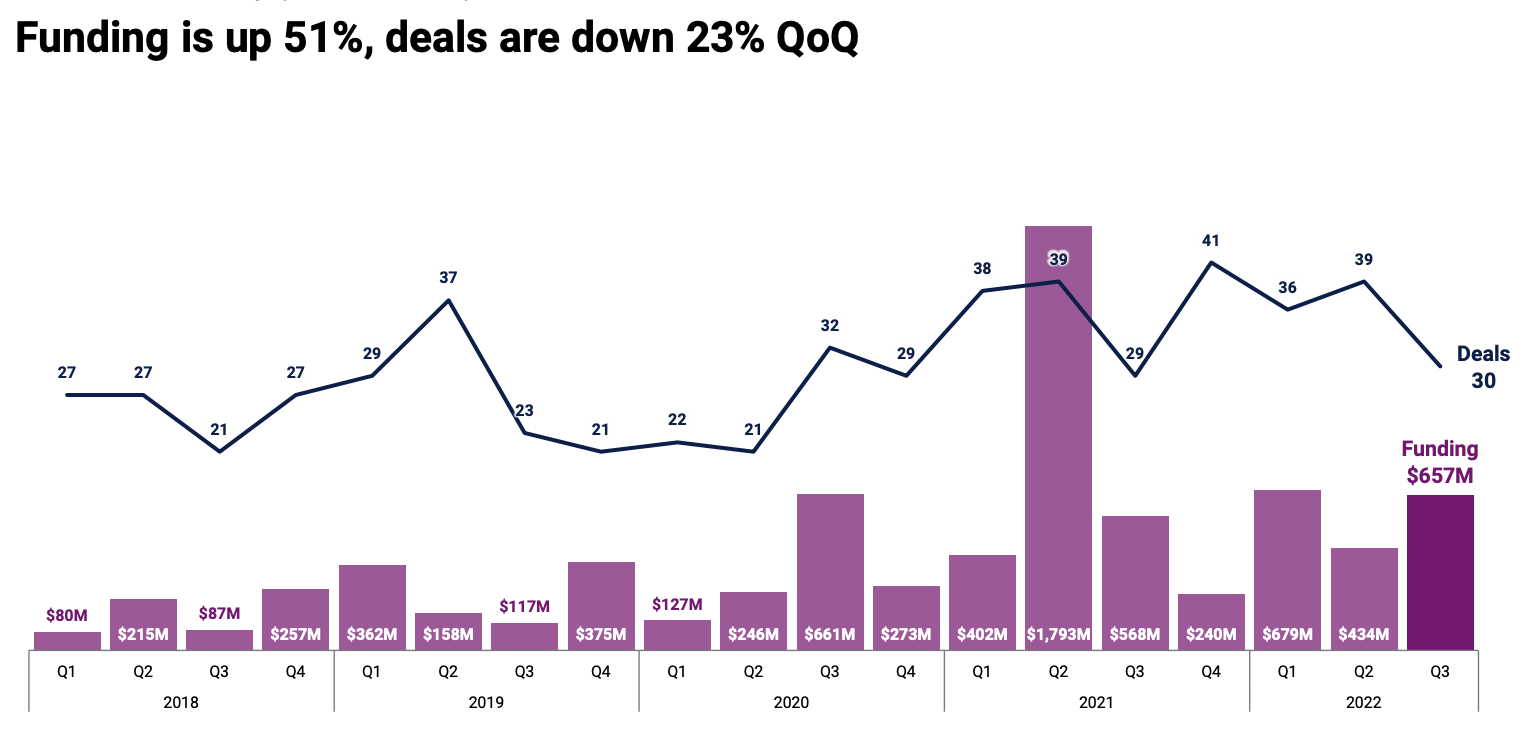

According to CB Insights’ State of Insurtech Q3 2022 report, European insurtech companies secured a total of US$1.77 billion in the first three quarters of 2022, a 33.87% decline compared to the same period last year during which US$2.76 billion were raised.

Europe insurtech quarterly funding, Source: State of Insurtech Q3 2022, CB Insights

Looking at European trends, the report notes that the region’s insurtech industry is heavily concentrated around the value chain categories of Infrastructure (260 companies) and Marketing and Distribution (158 companies), which account for a combined 70% of all European insurtech companies.

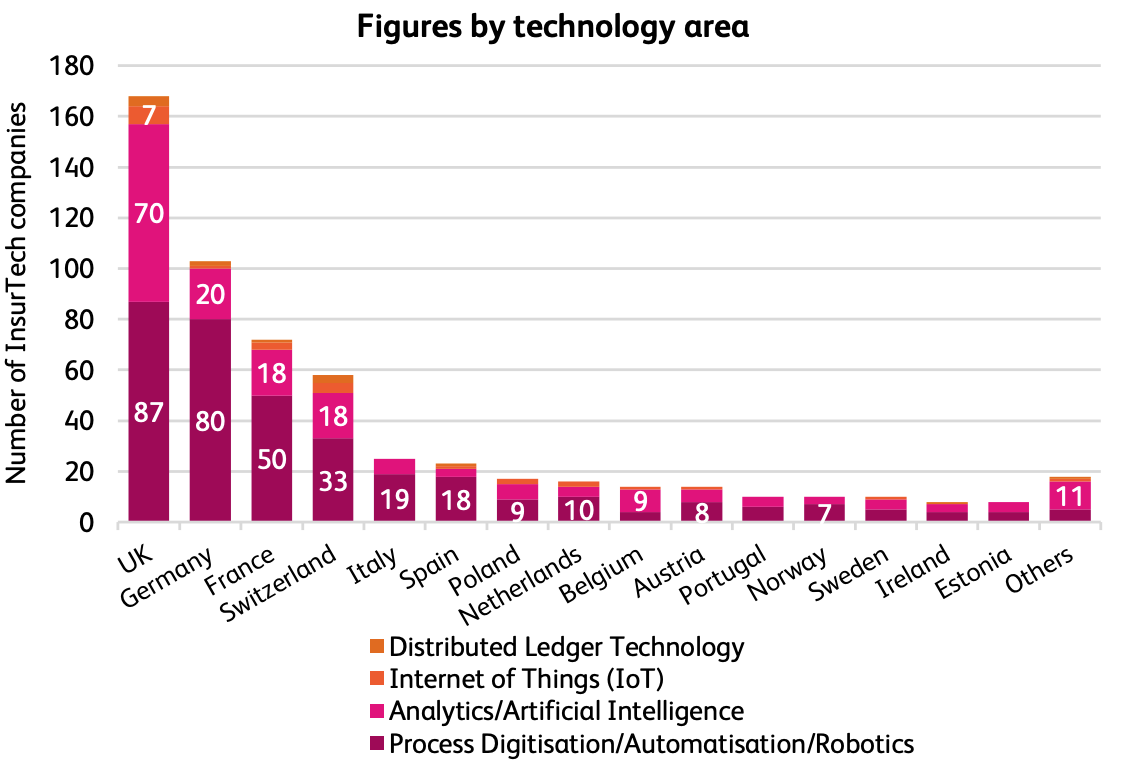

Concentration is also high in terms of the technologies employed, with Digitalization/Automatization/Robotics (373 companies) and Analytics/Artificial Intelligence (AI) (188 companies) accounting for 94% of all European insurtech companies.

Number of European insurtechs by country of headquarters and technology area, Source: IFZ Insurtech Report 2022

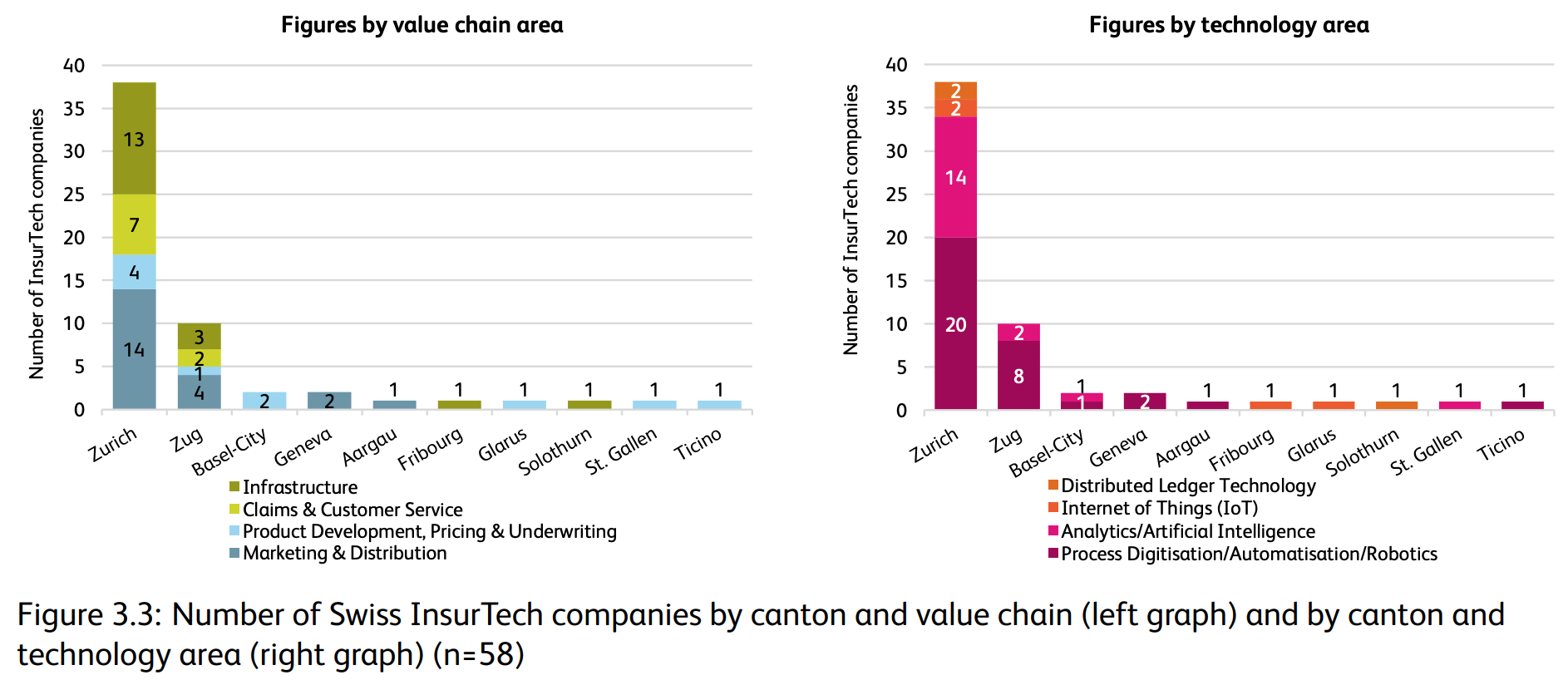

Similar to regional trends, Switzerland’s insurtech is also heavily centered around Marketing and Distribution with 21 companies (36% of all Swiss insurtech companies), followed by Infrastructure solutions with 18 companies (31%). 33 Swiss insurtech companies indicated primarily using Process Digitalization/Automation/Robotics, making it the most prevalent technology (57%), followed by Analytics/AI with 18 companies (31%).

Number of Swiss insurtech companies by canton and value chain (left graph) and by canton and technology area (right graph), Source: IFZ Insurtech Report 2022

Like last year, findings from the 2022 IFZ research show that most Swiss insurtech companies are pursuing an international strategy, with 69% of the 58 Swiss insurtech companies indicating targeting customers in different countries, a proportion that’s 11 point higher than the regional average of 58%.

Findings from IFZ are consistent with those observed by other industry stakeholders. Data from by the Insurtech Map show that Germany, Austria, Switzerland and Liechtenstein, also referred to as the DACH region, have seen their insurtech sector increase by 45% over the past year, rising from 141 players in March 2021 to now 202.

A recent report by consulting firm PwC notes that Switzerland’s incumbent insurers have played an active role in fostering innovation in the sector.

Baloise, for example, is engaged with insurtech centers on four areas, namely home, mobility, financial wellness and business services. The firm has also made direct investments into companies like Omni:us, a Berlin-based startup specializing in services that use AI to extract relevant data points from heterogeneous document streams; Trov, a Californian insurtech company that offers on-demand single-item insurance; and Stable, a London-based startup that has created an index insurance product for food and farming businesses around the world that automatically reimburses lost income caused by volatile prices.

Swiss Life has set up an incubator and corporate venture capital fund, the report says. It also uses equity interests and collaborates with startups to access insurtech capabilities to complement its internal digitalization efforts. An example is Swiss Life’s 2021 partnership with Appian to create an end-to-end AI solution for underwriting.

And Vaudoise has embraced a digital strategy focused on establishing partnerships with startups and integrating its digital solutions into ecosystems of third parties, it notes. Initiatives include investing in a fund giving access to fintech, insurtech and regtech startups, and participating in joint ventures, equity investments and non-equity collaborations.