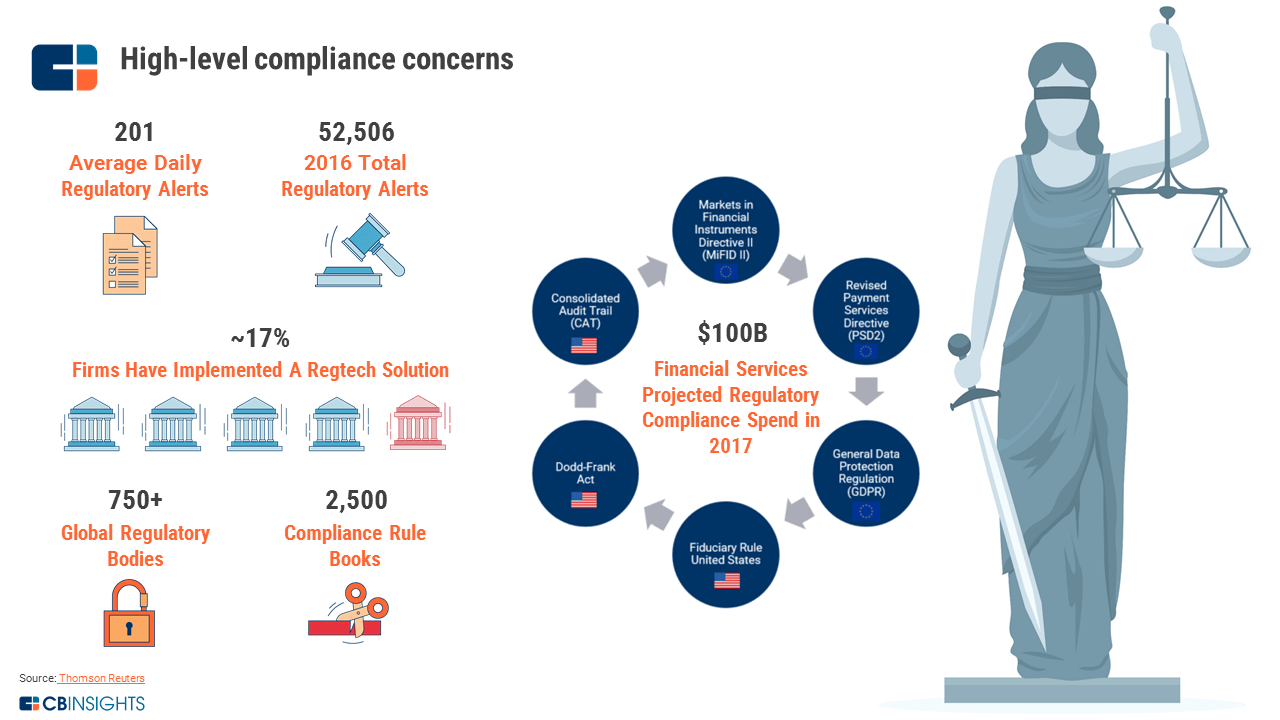

Banks and firms are increasingly turning to regtech solutions that leverage software and automation to close compliance gaps, address new regulatory challenges and cut costs.

Regtech refers to technology and software created to address regulatory requirements and help companies stay compliant. Solutions range from software to automate workflow, to advanced technology like machine learning, natural language processing (NLP), and blockchain to replace old policies and procedures.

Regtech companies are saving firms billions in regulatory fines and as the regulatory landscape expands with regulators issuing record levels in non-compliances fines, and pending rulings such as GDPR, PSD2, and MiFIDII/MIFIR, regtech solutions are enabling firms to fill compliance gaps, get ahead of requirements before deadlines and detect enterprise risk.

Regtech has gained traction in recent years with companies in the space raising over US$6.2 billion across approximately 680 equity investments since 2013, according to CB Insights.

In Europe, the UK is leading the industry in terms of funding but also in terms of the number of regtech companies serving the financial services industry.

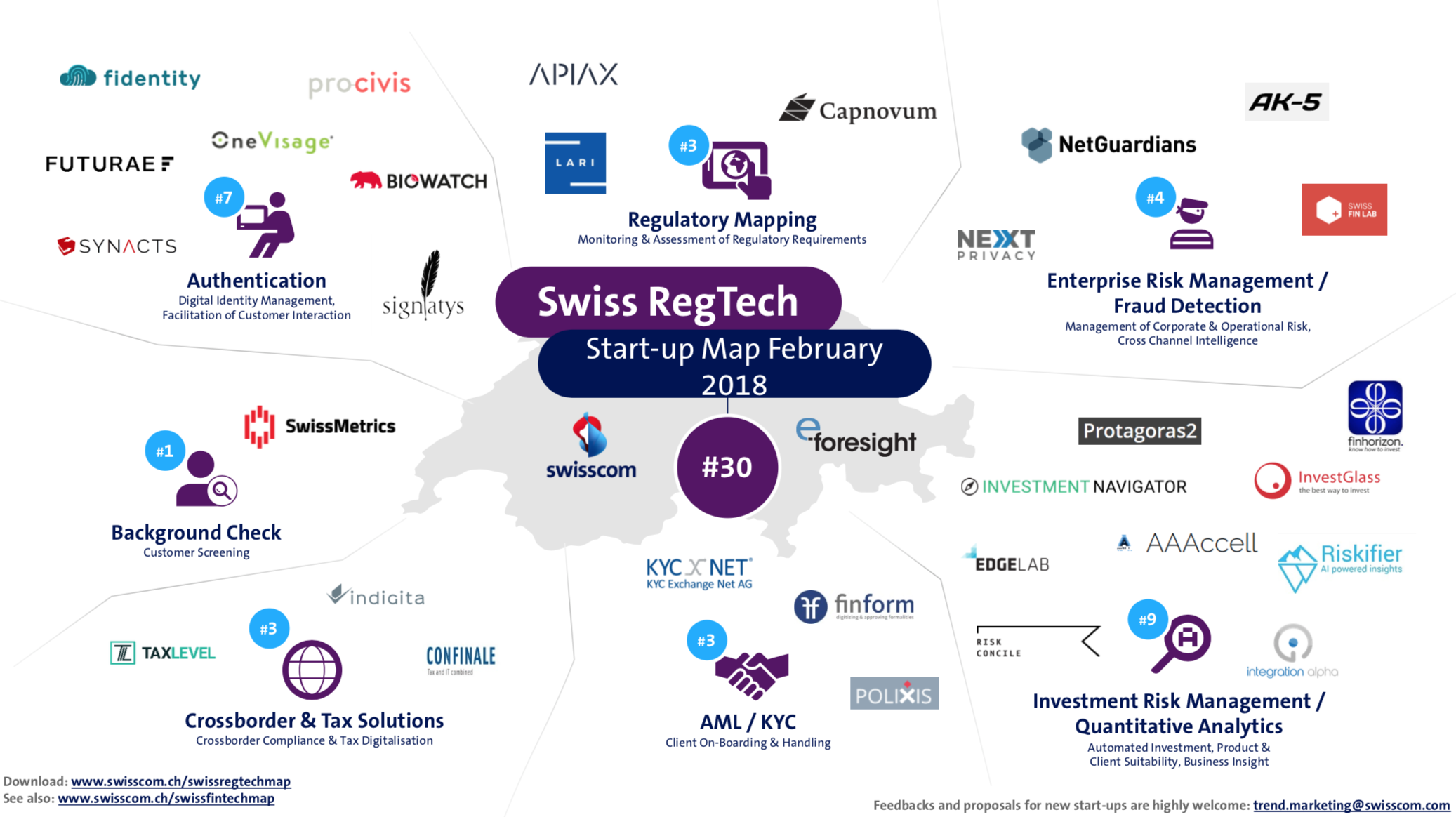

Nevertheless, the Swiss regtech industry is growing rapidly with now 30 ventures, according to Swisscom’s Swiss RegTech Map.

Regtech in Switzerland

Several Swiss regtech ventures have emerged as industry leaders. Apiax, for instance, offers a flexible technical solution that can be used for many different use cases.

Headquartered in Zurich, the company combines legal and compliance expertise with cutting-edge technology to help clients transform complex regulations into machine-readable digital compliance rules and manage regulations digitally.

The platform consists of digital rule sets, which are kept up-to-date and verified by premium content providers, and of a regulatory cockpit for legal and compliance teams to manage regulatory updates, review and deploy them.

The rule engine is infrastructure independent, running in a private or public cloud. The rules can be easily integrated into any system or process over an API.

Apiax raised US$1.5 million in seed funding in September last year from Peter Kurer, DIventures, the Swiss ICT Investor Club (SICTIC), Zürcher Kantonalbank and Tugboat. (a nice portrait written by Julius Baer about Apiax can be found here)

Another notable regtech firm in Switzerland is Qumram, an award-winning startup and a venturelab alumnus. Qumram captures digital activity and interactions, including web, social and mobile, to ensure compliance, prevent fraud and improve customer service. Digital activities and interactions are recorded and replayed in movie-like form, providing a transparent digital audit trail for financial services organizations. This allows them to comply with regulatory requirements for digital record-keeping.

Qumram also facilitates fraud detection by monitoring digital behavior of employees as well as interactions from external sources, and delivers actionable customer insights that improve customer experience.

Qumram was named the Best Regtech Company in the 2017 Fintech Breakthrough Awards and the Growth Stage Startup of the Year in the 2017 Swiss Fintech Awards. The startup also won the 2016 Swisscom Startup Challenge.

Qumram was acquired in November 2017 by Dynatrace.

NetGuardians is another regtech player, providing automated compliance management software and real-time human behavior analysis to detect fraud. The startup provides an enterprise platform that helps financial institutions prevent banking fraud and digitize regulatory compliance.

Founded in 2007, NetGuardians was the first company to emerge from the innovation incubator Y-Parc in Yverdon-les-Bains, Switzerland. Today, the company has offices across Europe, but also in Africa and Southeast Asia.

NetGuardians raised its CHF 8.5 million Series C funding round last year and serves more than 50 international clients.

Anybody interested about Regtech Switzerland should check out the Swiss Chapter of the International Regtech Assocation.

The Swiss Chapter of the International RegTech Association (IRTA CH) aims to:

- fosters an open and innovative RegTech ecosystem across industries in Switzerland and abroad,

- promotes the exchange of views and the collaboration between RegTech providers, regulators, industry organizations, science, professional advisors, service providers and consumers and

- is open to private persons and legal entities as well as organizations under public law and represents the interests of its members.