Revolut, Wise and Neon Are the Cheapest Neobanks in Switzerland

by Fintechnews Switzerland October 20, 2022Online comparison service moneyland.ch conducted a study to compare the cost of using banking, card and foreign exchange services provided by seven leading neobanks in Switzerland — CSX, Neon, Revolut, Wise, Yapeal, Yuh, and Zak.

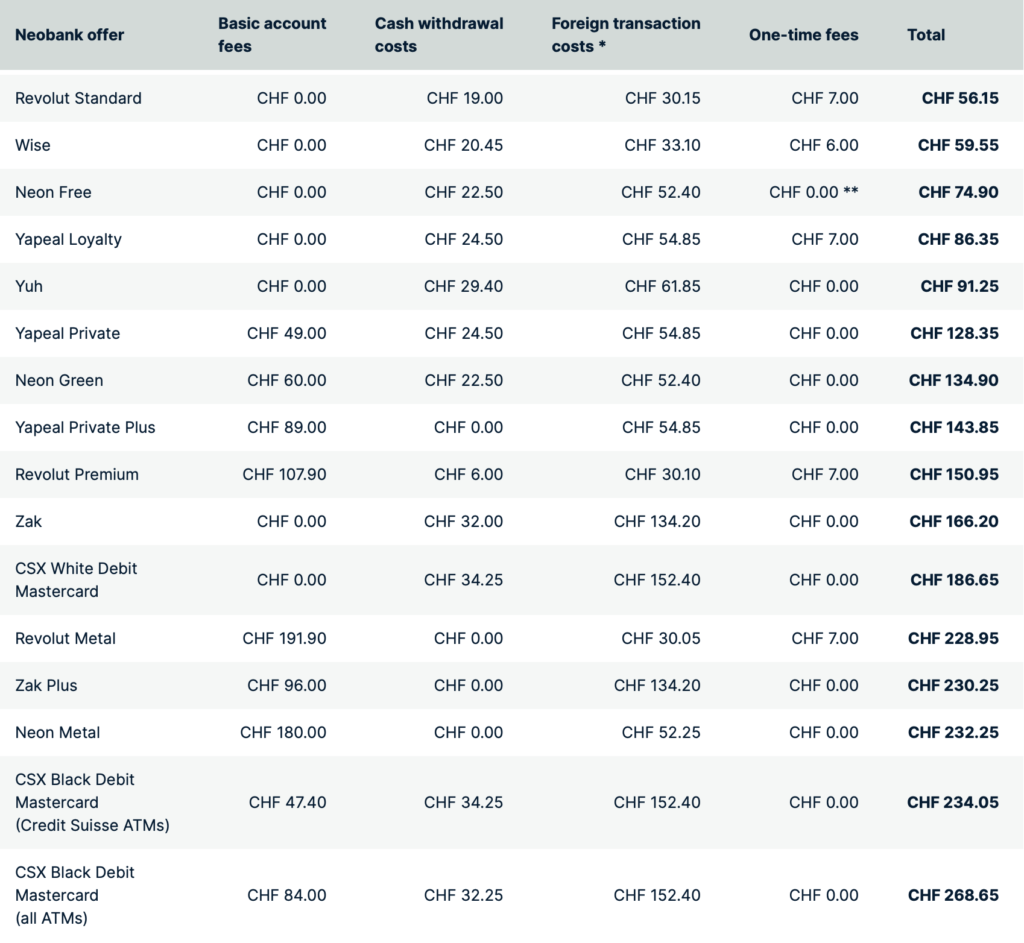

The study found British neobanks Revolut and Wise to be the cheapest options overall, followed by Swiss neobanks Neon and Yuh.

Digital payments and neobank awareness are on the rise in Switzerland, according to research from the Swiss Payment Monitor, with eight out of 10 card payments processed contactlessly in 2020.

Nevertheless, a separate study also found that Swiss residents remain reluctant to join neobanks and non-traditional banking providers, with around 80% of those surveyed having little to no interest in banking with such companies.

More than 310 neobanks have launched around the world in the past decade, attracting an estimated 39 million users globally, with most of them located in Europe.

Cost of neobank’s credit cards and transactions

The study found that Revolut and Wise provided the cheapest card transactions, followed by Swiss neobank Neon. Meanwhile, Credit Suisse’s neobank CSX was the most costly option.

Wise and Revolut were again the cheapest neobanks when it came to international transactions, followed by Neon, Yapeal and Yuh. Zak and CSX were found to be five times more expensive than the cheapest options.

Online comparison service moneyland.ch compared seven neobanks available to Swiss consumers. Revolut, Wise, and Neon are the cheapest. Source: moneyland.ch

Conventional Swiss credit cards are still the most favourable option for purchases in Switzerland since cards from neobanks — while free to use for customers — do not reward cash back.

Most neobanks have foreign transaction costs of under one percent for CHF to EUR exchanges. The only neobanks of the seven studied with currency exchange costs above one percent are Zak and CSX.

The foreign transaction costs of most conventional Swiss credit cards, on the other hand, equal between three and five percent of the transacted amount.

Different types of neobank accounts

All the neobanks included in the study have offers with no basic account fees and all offered cash withdrawals at ATMs and card payments at physical and online shops.

Neobanks also offer a wide selection of paid accounts. In some cases, paid premium accounts work out cheaper than offers with no basic account fees when total costs were considered.

For example, while Revolut will begin charging a fee on 25 October 2022 when users add money to their standard account using a debit or credit card issued in Switzerland, top-ups to their paid accounts remain free.

CSX, Yapeal, and Zak also have paid accounts which include complimentary ATM cash withdrawals, while Yapeal only offers fee-free bank transfers in its paid accounts.

Neon offers accounts with metal payment cards and has a sustainable account which helps finance the planting of trees in users’ names.

Neobanks with Swiss bank accounts

However, not all of the neobanks included in the study offer bank accounts in Switzerland.

Revolut and Wise do not include a Swiss bank account, while the Yapeal Loyalty account provides a bank account number for receiving transfers but does not allow users to transfer money to other bank accounts.

Neobanks generally do not charge bank transfer services charge fees for transfers to and from other Swiss bank accounts.

Currently, the only neobanks which pay interest on private account balances are Yuh and Zak.

Swiss neobank Yuh came in first place in the comparison limited to neobanks who do offer Swiss bank accounts, followed closely by Neon. Yappeal came in a distant third, while CSX was significantly more costly in all aspects.