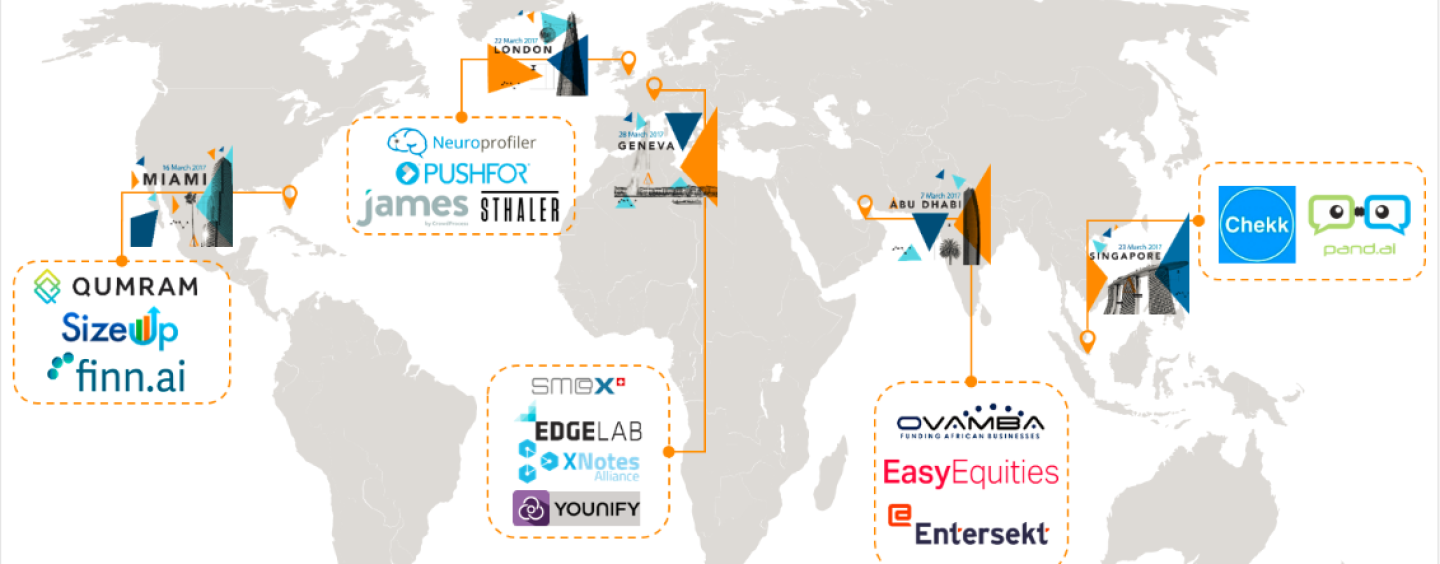

Next month, we will be hosting our series of Innovation Jams. The Jams are competitions which take place in 5 cities (Singapore, Miami, Abu Dhabi, London and Geneva) aimed at finding the most interesting fintech start-ups from across the globe. The two winners from each Jam then travel to the Temenos Community Forum in Lisbon to battle for the title of global Innovation Jam champion.

The Jams tell us a lot about the fintech industry. We kicked off the Jams in 2015, so this is now the third year. Obviously we will have a much better feel for the state of the fintech industry in five weeks’ time, but having already reviewed hundreds of entries and compared them against previous years, we are getting a sense for what is changing. Here are a few themes:

Strong regional differences

As is inevitable as fintech matures, we are starting to see some distinct areas of geographical specialization. For example, in the UK we saw a far higher number of applications from fintechs providing payment services, perhaps not unsurprising given the historical strength of London as a payments hub, but also from AI-related fintech companies.

The latter possibly owes to the strong AI expertise in the UK’s leading universities, which have helped create successful companies like DeepMind and SwiftKey, bought by Google and Microsoft, respectively. In Switzerland, we saw an outsized focus on wealth management, which makes sense given the high relative importance of this industry, but also on blockchain and big data, areas where local universities are strong and where clusters are forming.

In MEA, there was a bigger emphasis on financial inclusion likely because of the still very high levels of unbanked people, especially in Africa. In Singapore, there was a stronger relative weighting towards security, while in the US we saw a much higher number of companies focusing on User Experience, possibly because this is an area where banks can invest even when – as most have – their processing has been outsourced.

The growth of Regtech

Compared to 2016 and especially compared to 2015, we have seen a massive increase in the number of regtech applicants. We also consider this a sign of maturity. The first wave of fintech companies were focused predominantly on those areas with low regulation/high potential margins like FX and automated investments. But now we see companies going deeper into middle and back office, investigating blockchain for instance, but also with a heavy focus on regtech.

As an area which has been sucking up banks’ time, resources and bandwidth over recent years (At JP Morgan, compliance headcount is up 87% since 2011, from 23,000 to 43,000), the opportunity for those fintech companies offering smarter, cheaper ways for banks to comply with regulation is clear. Some of the regtechs competing in this year’s Jams that caught our attention are:

- Neuroprofiler, a French start-up which applies behavioural science and AI to create games that ensure compliance with less cost and better customer experience. At the London Innovation Jam, they will be demoing a game for MiFID II compliance.

- Qumram – a Swiss firm demoing at the Miami Innovation Jam, Qumram records every user session on any device – every keystroke, every button click– which can be replayed in movie quality at a moment’s notice, giving indisputable evidence of all digital interactions, in accordance with global regulatory requirements.

- Edgelab – another Swiss company, demoing at the Geneva Innovation Jam, takes a big data approach to risk management, analyzing over 1bn data points daily to enable banks to construct portfolios that are always compliant with regulation, always optimized to maximize risk/reward and which can model for market turbulence.

- Pushfor – which lets a bank securely share content with its customers – content is ‘pushed’ without the file leaving its source destination –with customizable viewing permissions combined with real-time tracking, full audit trail and usage analytics.

Fintech 3.0

If fintech 1.0 was firms tackling the low hanging fruit and fintech 2.0 was fintechs beginning to offer more heavily regulated services and moving deeper into middle and back office, then fintech 3.0 seems to be about taking a fresh look at prevailing business models.

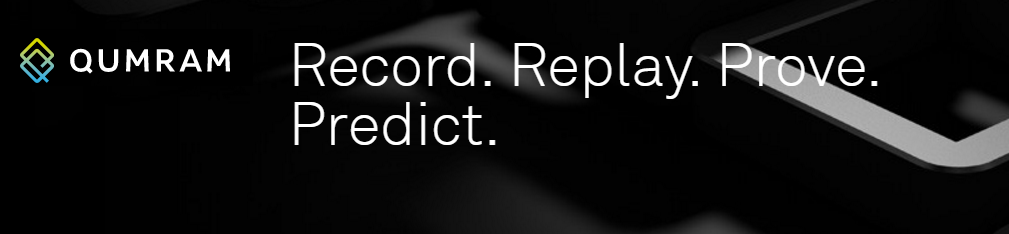

One such model is to offer marketplaces (see below), but we also see several examples of firms launching new generation versions of what were until very recently highly disruptive models (think Spotify vs iTunes). One very interesting example is Ovamba, which is competing in the Abu Dhabi Innovation Jam.

Ovamba is a marketplace lending platform with SMEs on the one side and mainly institutional money on the other. So pretty standard so far. But the twist is that as well as lending the funds for firms to buy inventory/inputs, it also orders the inventory (gaining purchasing economies of scale), holds it (gaining warehousing economies of scale) and distributes it to the borrower only as borrower makes payments, limiting the likelihood of default as well as protecting through collateral any downside risk.

Other examples include EasyEquities, which has taken some of the existing tools for democratizing investing such as fractional shares and combined with e-commerce features like recommendations, baskets and buckets to help overcome inertia about what types of investments to make, and XNotes.

XNotes has created a new blockchain for managing corporate assets which has several unique and interesting properties like configurable workflows (e.g. to manage the flow of goods for supply chain finance) and configurable consensus (e.g two parties can agree on a third party to validate the existence or quantity of a good).

Open Banking/Marketplaces

The other clear area of business model innovation is around open banking marketplaces (where APIs are used to allow third parties to build apps for, or to sell their services to/through, banks). The arrival of new legislation in Europe, such as PSD2, which obliges banks to share customer data with third-parties, makes these kinds of models more viable, while we observe a general shift in banks’ attitudes, seeing open banking as more of an opportunity than a threat. A lot of the new challenger bank models, such as N26 or Starling Bank, work on such a basis. Here are some of the interesting marketplace examples taking part in this year’s jams:

- Younify which offers an aggregation platform for banks, but with a suite of tools to manage the administrative tasks of their clients, such as automatically collecting and organizing digital documents, one click payment of invoices and one click digital signature of documents.

- SMEx, presenting at the Geneva innovation jam, has built an open marketplace for foreign currency exchange where participants can propose a currency exchange at no cost or match instantly the best bid/offer for 0.25% fee

- Sizeup: a platform – which can be licensed by banks – which allows SMEs to benchmark themselves against their peers across a range of areas such as revenues, salaries, etc. The data collected is then used to help the companies to make smarter decisions e.g about where to advertise, but can also be used to target them with the most relevant financial products and to inform lending and other decisions.

Security

Another area where we have seen a big increase in activity is security. A report last year from the Economist Intelligence Unit, commissioned by Temenos, found that 48% of retail bankers believe that by 2020 at least one major bank will disappear as a result of a cyberattack.

So this is clearly top of mind for banks and a fruitful area for fintechs to exploit. In addition, one largely overlooked aspect of open banking is the need to invest in security since banks will be sharing data across a much broader range of intermediaries, which will increase disproportionately the scope for cybercrime.

Entersekt, competing in the Abu Dhabi Innovation Jam, turns mobile phones into a trusted second factor of authentication. Its patented technology creates an isolated communication channel between phone and financial institution that ensures that no communications can be decrypted or spoofed by anyone at any point between the device and the bank.

Chekk, competing in Singapore, is a mobile solution that provides users with a secure wallet of their personal information that allows them to share information that is current and only the information required for a given transaction, putting the user in control over their own privacy.

Sthaler, whose product Fingpay reads the vein structure within people’s fingers (totally unique to every individual) to authenticate them so they can securely pay for goods and services, to gain entry to events and to manage payments online.

AI/bots

There have been big advancements in AI over just a short number years owing to better algorithms, much larger datasets for training them, cheaper and faster cloud-based infrastructure and new computing techniques like parallel computing. On the back of this, we are seeing many more AI-related fintechs entering the jams, especially compared to two years ago.

An interesting example from the UK is Crowdprocess whose product James leverages machine learning algorithms to create high-performing predictive models and scorecards for credit risk management.

We have also seen lots of chatbot entrants such as Finn.ai from Canada, which is competing in the Miami Jam, and Pand.ai, which stands out on the basis of using deep learning to constantly improve the quality of its conversation, having contextual memory to understand what has been discussed before, and an algorithm that determines the right content to serve up to each individual.

Why not join us?

The world of fintech is evolving quickly while the impetus to collaborate is growing strongly. The Temenos Innovation Jams offer industry expert insight into the changes taking place at the same time as exposure to more than 60 of the most exciting new fintech companies.

The jams are on 7 March in Abu Dhabi, 16 March in Miami, 22 March in London, 23 March in Singapore and 28 March in Geneva. You can register here: http://bit.ly/2lXLfjR

This article first appeared – Linkedin.com