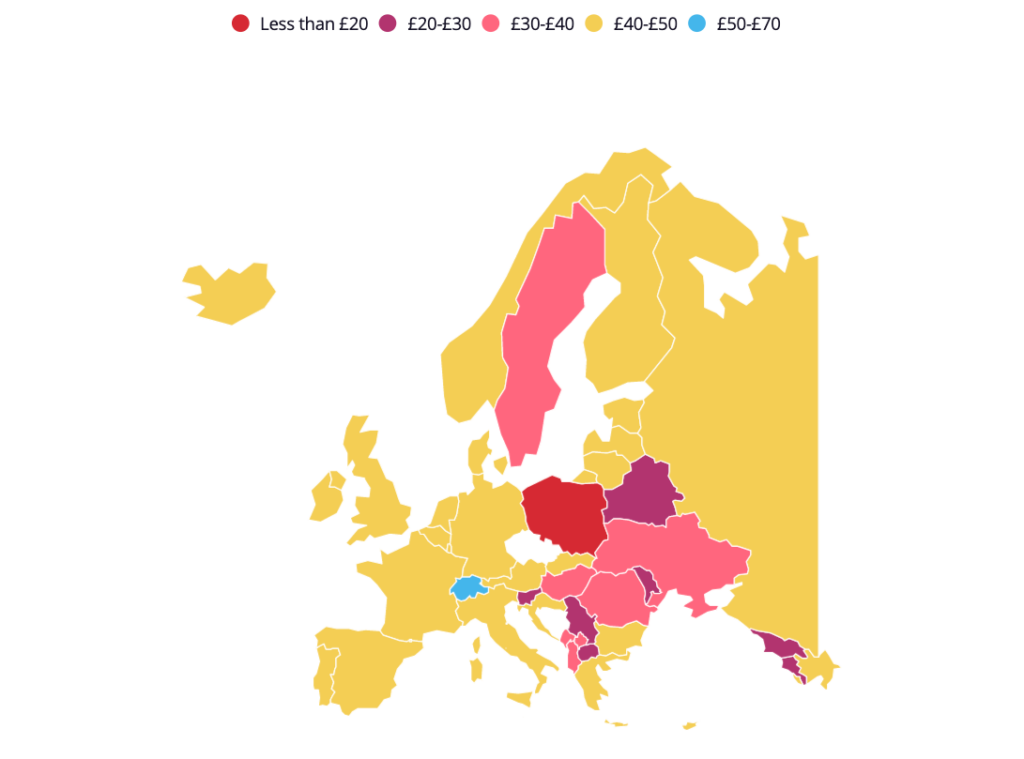

Switzerland Has The Highest Contactless Payment Limit In Europe

by Fintechnews Switzerland July 12, 2021Switzerland’s contactless payment limit stands at CHF 80 (approximately GBP 63) – the highest in Europe, a new study has found. Approximately two-thirds of the Swiss population currently owns a credit card but the country still lags far behind on the list of global cashless economies.

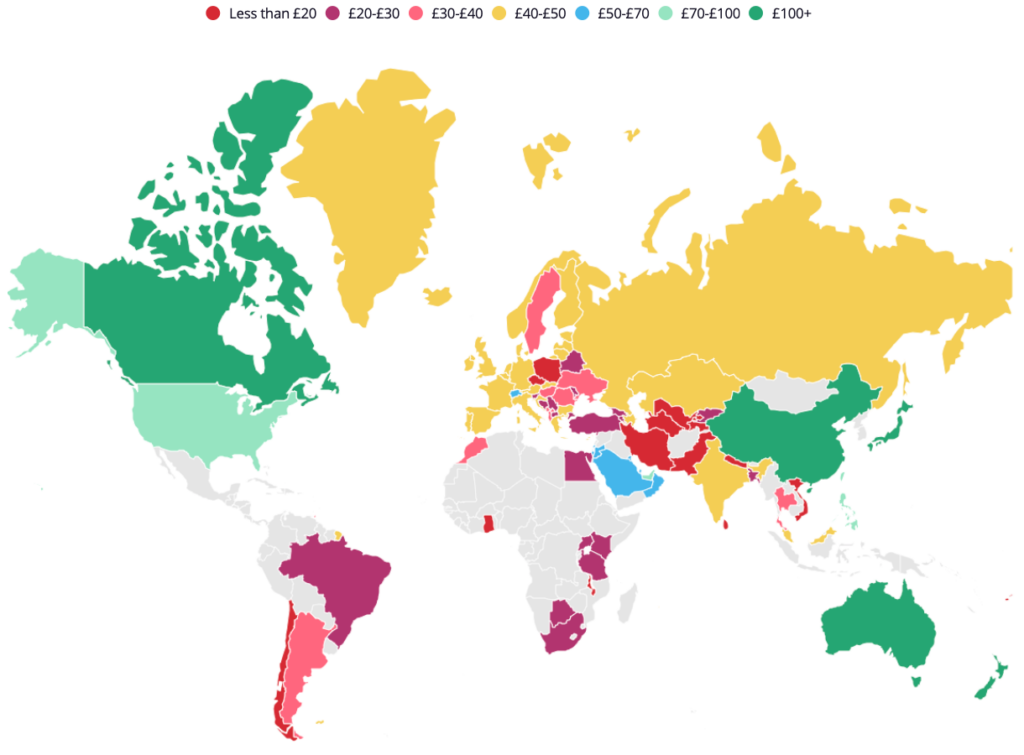

The top 15 global cashless countries were compiled by rating them based on the percentages of the population that own a credit and debit card, contactless payment limits, number of major e-wallet players and ATMs per 100,000 adults. Singapore ranks ninth on the list which is topped by Canada, followed by Hong Kong and Singapore.

Canada has the highest contactless spending limit in the world at GBP 147 – more than twice that of Switzerland, the study notes. Moreover, Canada also leads the world in credit card usage – 83% of the population own a credit card. In 2020, Visa and Mastercard increased the contactless payment limit in Canada by 150%, from C$100 (GBP 58) to C$250 (GBP 147).

At GBP 107, Singapore has the highest cashless spending limit in Asia, with 92% of the population owning a debit card. Moreover, Asian countries account for half of the economies with the highest cashless spending limits, the study indicates.

James Andrews, senior personal finance expert at money.co.uk said,

“Before the coronavirus pandemic, we were beginning to see a global shift away from paper money towards electronic payments, and that move has been massively accelerated since restrictions aimed at limiting the spread of the virus came into effect. In the past 12 months, we’ve witnessed more than 40 countries increase the limits for contactless transactions and in the UK the government has placed emphasis on using contactless methods of payment where possible.”

The world has been gradually moving away from cash for the past few years. For instance, cash usage in the UK has been steadily declining at 15% since 2017.

But the lockdowns imposed to curb the spread of the virus resulted in a major shift towards online payments and transactions. Moreover, as people became wary of transmission risks from paper money, contactless payments gained preference.

In the UK, cash usage fell by 35% last year – more than double the rate of decline since 2017. And while overall card payments declined in the UK in 2020, their share of payments increased with over half of all payments made using cards. According to the study, UK has the fourth highest contactless spending limit in Europe after Switzerland, Liechtenstein (GBP 63) and Russia (GBP 48)

Earlier this year, the UK government announced changes to its rules to allow for an increase in the single contactless transaction limit to GBP 100. Following this change, the UK will have the seventh-highest contactless payment limit in the world, rising above the UAE, Bahrain, Hong Kong and Taiwan.

Switzerland remains a cash dominant society against the general trend across the continent. A 2017 survey found that 70% of transactions in Switzerland take place in cash.

The move away from cash towards plastic payment methods and e-wallets have several advantages, said Andrews. Cashless payments are not only quick and easy, but the creation of digital paper trails can also help reduce tax fraud and money laundering, he said.

Moreover, cashless transactions require retailers to spend less time sorting out a cash float at the start of the day and fewer trips to the bank for deposits. It also reduces the risk of loss from theft.

Andrews added,

“However, as with many technological advancements, there is some concern that the change could leave vulnerable individuals behind. As things stand, shops are also well within their rights to refuse cash payments in the UK if they choose to go fully cashless – potentially excluding people unwilling or unable to pay with a card or smart device.”

Additionally, for people travelling abroad, the lack of cash option could mean paying hefty card charges if they do not have a suitable contactless travel card, Andrews said.

This means that any move towards a fully cashless economy requires infrastructural and legislative changes to ensure everyone is equipped with the necessary tools for cashless transactions, Andrews emphasises.

Featured image credit: Freepik