Latin America (LatAm)’s fintech revolution continues its course this year. Investors’ confidence remains high as they continue pouring billions into the space, betting on the prospect of fintech to help improve financial inclusion and bring innovation in the outdated banking and financial sector.

Several trends are emerging this year on the back of changing market dynamics, evolving customer habit and government initiatives. Here we look at five key fintech trends to look out for in LatAm.

Neobanking continues to lead LatAm’s fintech boom

LatAm’s fintech boom is showing no signs of slowing down as unicorns continue to grow and investors keep on pouring capital into the space.

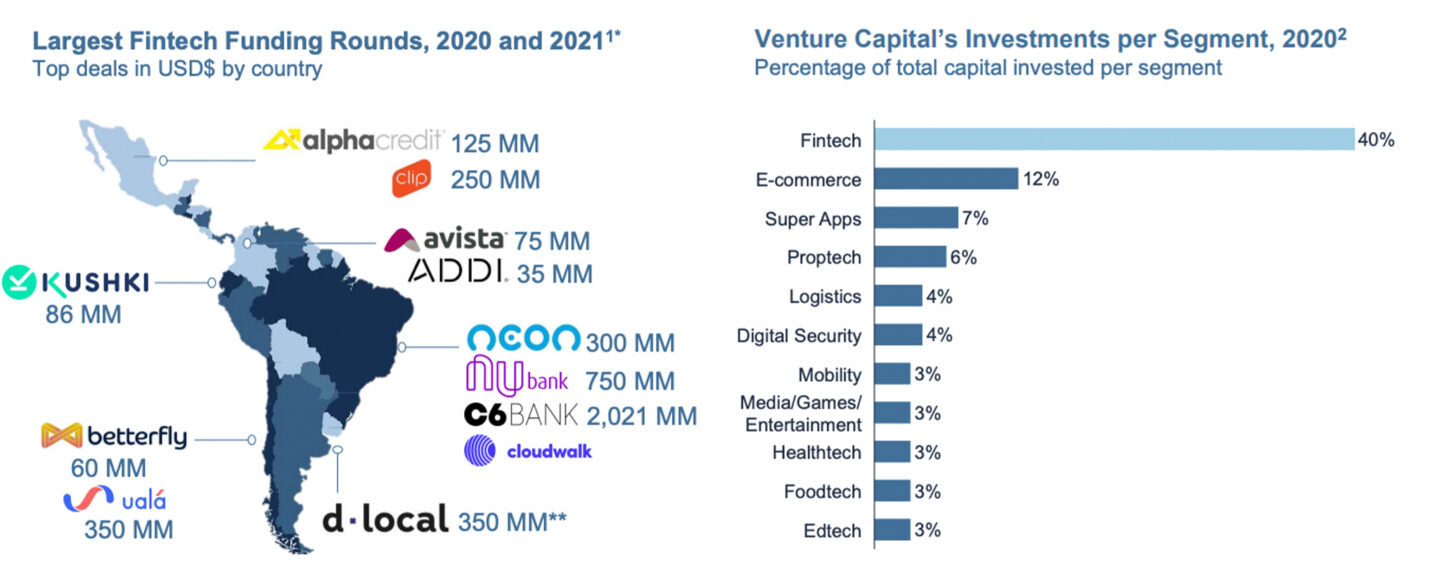

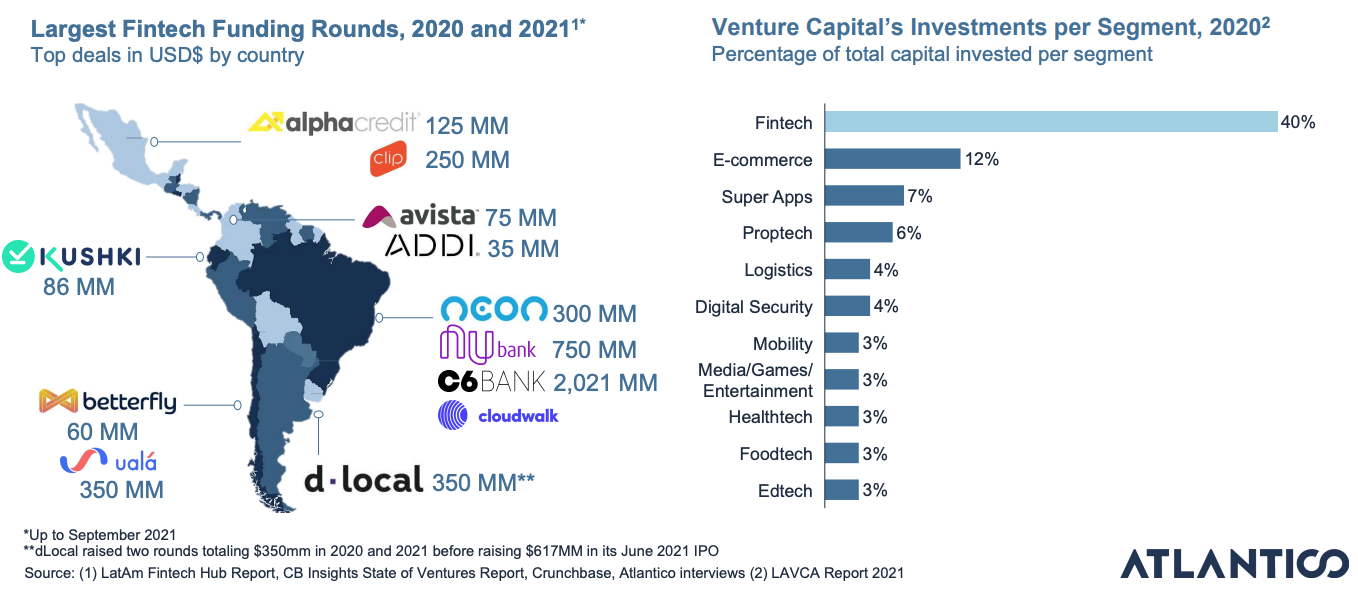

LatAm’s fintechs attracted 40% of all venture capital (VC) investments in 2020, with some of the largest rounds of 2020/2021 going towards neobanks, including Neon, Nubank and C6 Bank, according to the Latin America Digital Transformation Report 2021 by Atlantico.

Latin America’s fintech boom, Source: Altantico, Latin America Digital Transformation Report 2021, Sep 2021

In 2021, neobanks continue to lead the fintech sector, showing astonishing growth. Brazil remains the region’s leader both in terms of sector development and consumer adoption.

Out of the 52 neobanks identified in LatAm, 24 players are from Brazil, and out of a pool of 77 million neobank customers in 2021, 63.5 million are located in Brazil, or 82.5% of the region’s total neobank customers.

Digital payments surge on real-time payment rails

While cash remains king, digital payments across LatAm are steadily taking off with the introduction of fast payment systems, notes the Atlantico report.

In Brazil, fast retail payment system Pix is thriving. In less than a year since its launch by the central bank, Pix has moved about US$89 billion worth of transactions and some 110 million Brazilians have used the system at least once, according to a Bloomberg report.

In Mexico, the central bank launched in 2019 Cobro Digital (CoDi), an instant payment platform for the retail market running on SPEI, a real-time gross settlements payment system. Adoption of CoDi has been somewhat slow but nevertheless rising. In December, a survey by the Bank of Mexico, found that 4% of the population used the SPEI system versus 0.5% pre-pandemic. As of June 2021, CoDi had 9.31 million accounts and had processed about US$97 million worth of transactions.

Fueling the growth of e-commerce

The rise of digital payments and fintechs, coupled with the COVID-19 pandemic, is fueling growth in e-commerce.

Data company Statista estimates that 13 million people across LatAm made an online transaction for the first time last year, while retail e-commerce expanded by 36.7% to around US$85 billion.

In Mexico, online sales surged 65% in 2020 while physical retail sales fell 5.1% as a direct impact of COVID-19, according to David Bernardo, CEO of LITS Adventures, a Mexico City‑based digital transformation specialist.

Indicative of this trend are the growth figures reported by MercadoLibre, LatAm’s e-commerce giant. In Q3 2021, MercadoLibre posted a 68% jump in quarterly revenue. Gross merchandise volume rose 23.9% to US$7.31 billion while its active userbase increased by 3% to 78.7 million. MercadoLibre, originally from Argentina, is present in 18 countries, including Brazil, Mexico and Colombia.

A crypto hub in the making

2021 has seen investors pour millions into LatAm cryptocurrency startups. These raised a total of US$517 million in VC funding in H1, the Association for Private Capital Investment in Latin America (LAVCA) told CoinDesk.

The year also saw the minting of two crypto unicorns: Mexican crypto exchange Bitso, valued US$2.2 billion, and Mercado Bitcoin, the largest crypto exchange in Brazil worth US$2.1 billion.

The flood of fresh money is sparking early signs of consolidation in the market with a number of mergers and acquisitions being announced this year. In February, Bitso bought Quedex, a crypto derivatives trading platform, based and regulated in Gibraltar. In January, Argentina’s crypto trading platform Ripio acquired BitcoinTrade, the second-largest crypto exchange in Brazil.

Amid rising institutional demand for exposure to crypto, Matba Rofex, Argentina’s largest futures market, told Bloomberg in October that it had submitted a proposal to the country’s securities regulator to launch bitcoin futures. The move would make Matba Rofex the first exchange to offer regulated bitcoin futures in the region.

Insurtech piques investors interest

Insurance penetration is still low in LatAm, leaving plenty of opportunity for growth.

In 2020, insurance premiums represented just about 4% of the gross domestic product (GDP) in Brazil and Chile, respectively, compared to 12% in the US and 4.5% in China, according to the Atlantico report. That figure is even lower for Mexico and Argentina at 2.6% and 2.2%, respectively.

Over the past years, a number of innovative insurtech players have emerged to digitalize the market. A number of them are now steadily picking up steam. 180° Seguros, for example, is a Brazilian startup that partners with businesses to create customized products that can be embedded in the end customer’s journey. In May, 180° Seguros raised US$8 million in what it claims to be the largest seed funding round ever recorded by an insurtech startup in LatAm.

Another noteworthy Brazilian insurtech is Justos. Justos uses data to improve the auto insurance process by measuring the way people drive and price insurance policies more accurately. This way, Justos claims it’s able to offer plans that are up to 30% cheaper than traditional plans. Just last month, Justos closed a US$35.8 million Series A funding round.